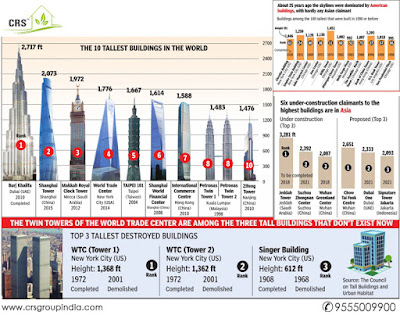

Dubai as of late declared that the city is set to get the tallest tower on the planet. The yet-to-benamed building is stipulated to be "a step taller" than the Burj Khalifa. Once the US had the loftiest structures, yet today Asia's interest for such high rises has put nine from the landmass among the globe's 10 most astounding structures.

1. Burj Khalifa: Dubai, United Arab Emirates - The Burj Khalifa, already known as the Burj Dubai, is the tallest working on the planet, ascending to a ludicrous 2,723 feet high with 163 stories. It took five years to assemble, and was finished in 2009 in Dubai's primary business locale.

2. Shanghai Tower: China - Shanghai Tower World second Tallest Building with 127 stories over the ground and 5 platform floors. 2,073 feet heights.

3. Makkah Royal Clock Tower Hotel: Mecca, Saudi Arabia - An endeavor to modernize this heavenly city, the Mecca Royal Hotel Clock Tower is the tallest inn on the planet, alongside the tallest clock-tower and containing the world's biggest clock-face. It remains at 1,972 feet high and has an astounding 120 stories.

4. One World Trade Center: New York, NY - Called both the Freedom Tower and One World Trade Center, this building will rise 104 stories high after its consummation in 2013. It will then be the tallest working in the Western Hemisphere. Its tower will extend its stature to 1,776 feet, referencing 1776, the year of American Independence.

5. Taipei 101: Taipei, Taiwan - With 5 stories underground and 101 over, the Taipei 101 ascents to a fantastic aggregate of 1,669 feet. It's likewise the biggest ecologically cognizant high rise on the planet, and is frequently where Taiwan dispatches its firecrackers amid national festivals.

6. Shanghai World Financial Center: Shanghai, China - Made up of office space, inns, and perception decks with a shopping center on the ground floor, the Shanghai World Financial Center achieved its full stature at 1,614 feet in 2007. It has 101 stories and the world's most noteworthy perception deck at 1,555 feet over the ground.

7. Global Commerce Center: Hong Kong, China - The International Commerce Center is a 1,588 feet tall high rise with a sum of 118 stories. It was finished in 2010 and stands as the tallest working in Hong Kong

8. Petronas Towers: Kuala Lumpur, Malaysia - Also known as the Petronas Twin Towers, these twin high rises are tied as the two number seven tallest structures on the planet. They used to hold the pined for spot at number one in 1998, yet in 2004 they were surpassed. They are however still the tallest twin structures on the planet, coming in at 1,483 feet high and 88 stories.

9. Zifeng Tower: Nanjing, China - The Zifeng Tower was finished in 2008 and is 1,480 feet tall with an aggregate of 89 stories. Outlined by Adrian Smith, the building's stair-step shape is utilitarian, isolating the retail focuses, office spaces, eateries, and an inn and open observatory inside.

1. Burj Khalifa: Dubai, United Arab Emirates - The Burj Khalifa, already known as the Burj Dubai, is the tallest working on the planet, ascending to a ludicrous 2,723 feet high with 163 stories. It took five years to assemble, and was finished in 2009 in Dubai's primary business locale.

2. Shanghai Tower: China - Shanghai Tower World second Tallest Building with 127 stories over the ground and 5 platform floors. 2,073 feet heights.

3. Makkah Royal Clock Tower Hotel: Mecca, Saudi Arabia - An endeavor to modernize this heavenly city, the Mecca Royal Hotel Clock Tower is the tallest inn on the planet, alongside the tallest clock-tower and containing the world's biggest clock-face. It remains at 1,972 feet high and has an astounding 120 stories.

4. One World Trade Center: New York, NY - Called both the Freedom Tower and One World Trade Center, this building will rise 104 stories high after its consummation in 2013. It will then be the tallest working in the Western Hemisphere. Its tower will extend its stature to 1,776 feet, referencing 1776, the year of American Independence.

5. Taipei 101: Taipei, Taiwan - With 5 stories underground and 101 over, the Taipei 101 ascents to a fantastic aggregate of 1,669 feet. It's likewise the biggest ecologically cognizant high rise on the planet, and is frequently where Taiwan dispatches its firecrackers amid national festivals.

6. Shanghai World Financial Center: Shanghai, China - Made up of office space, inns, and perception decks with a shopping center on the ground floor, the Shanghai World Financial Center achieved its full stature at 1,614 feet in 2007. It has 101 stories and the world's most noteworthy perception deck at 1,555 feet over the ground.

7. Global Commerce Center: Hong Kong, China - The International Commerce Center is a 1,588 feet tall high rise with a sum of 118 stories. It was finished in 2010 and stands as the tallest working in Hong Kong

8. Petronas Towers: Kuala Lumpur, Malaysia - Also known as the Petronas Twin Towers, these twin high rises are tied as the two number seven tallest structures on the planet. They used to hold the pined for spot at number one in 1998, yet in 2004 they were surpassed. They are however still the tallest twin structures on the planet, coming in at 1,483 feet high and 88 stories.

9. Zifeng Tower: Nanjing, China - The Zifeng Tower was finished in 2008 and is 1,480 feet tall with an aggregate of 89 stories. Outlined by Adrian Smith, the building's stair-step shape is utilitarian, isolating the retail focuses, office spaces, eateries, and an inn and open observatory inside.